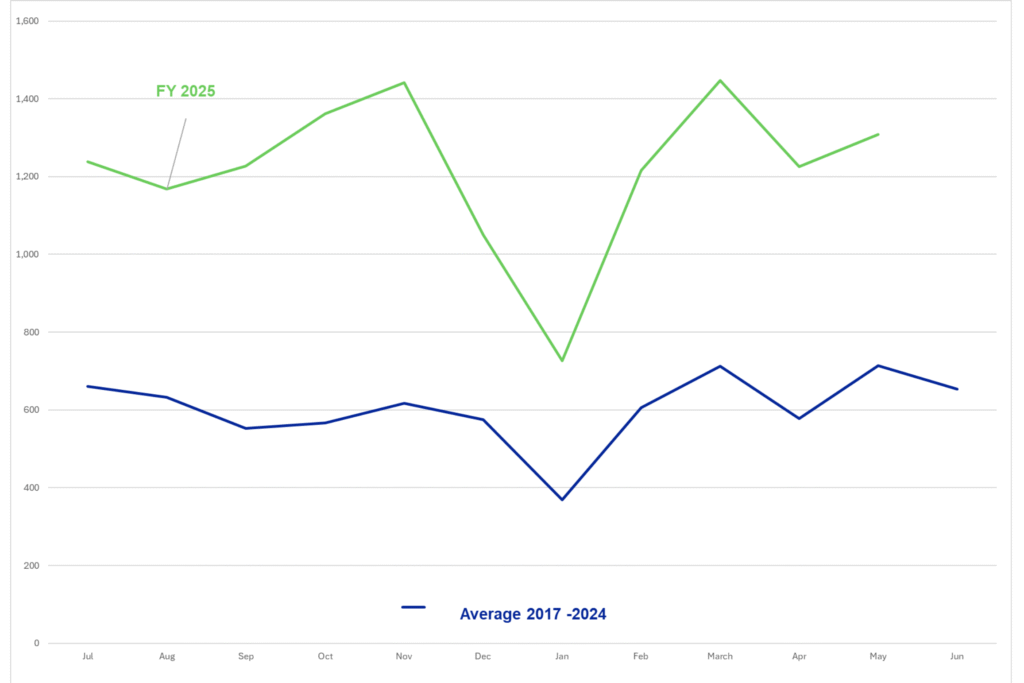

In May FY25, 1,308 businesses entered external administration for the first time—more than double the five-year average of 611.0, and higher than May FY24’s 1,249. Although slightly down from April’s 1,225, the figures remain significantly elevated, suggesting that financial stress across the economy is far from easing. Expectations of a slowdown following March’s peak have not materialized, reinforcing the […]

Why You Should Choose Only One Broker

One of the trickiest conversations we have with potential clients is this: “Please only choose one broker to go to market with.” It can feel a bit uncomfortable. especially when we’re talking about a product most people don’t know much about, to say: “Don’t go anywhere else, just stick with us,” without sounding like a […]

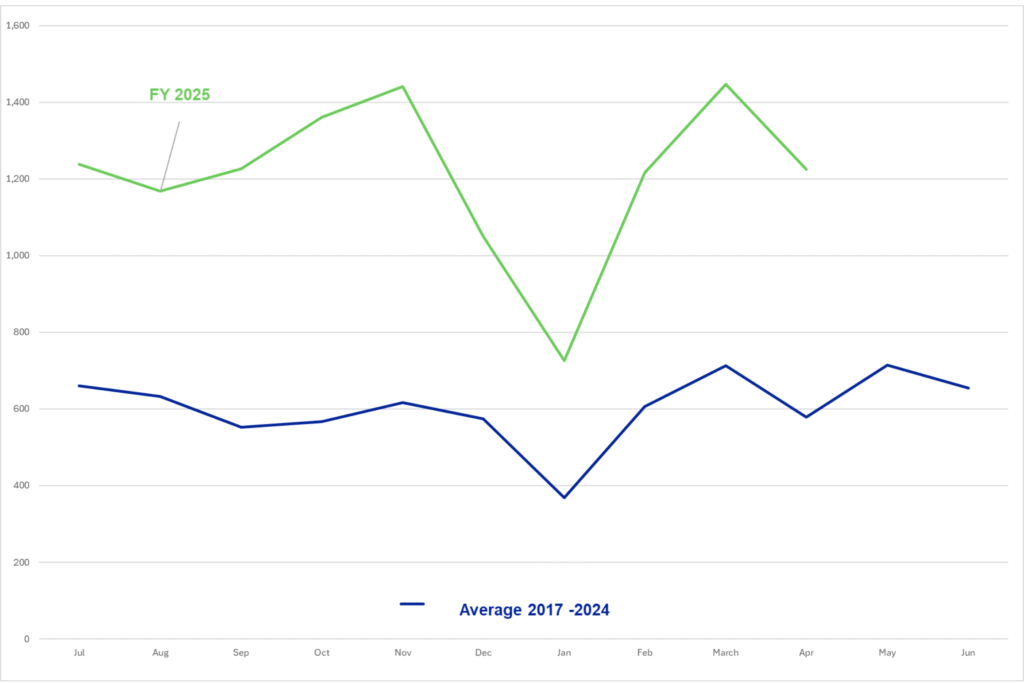

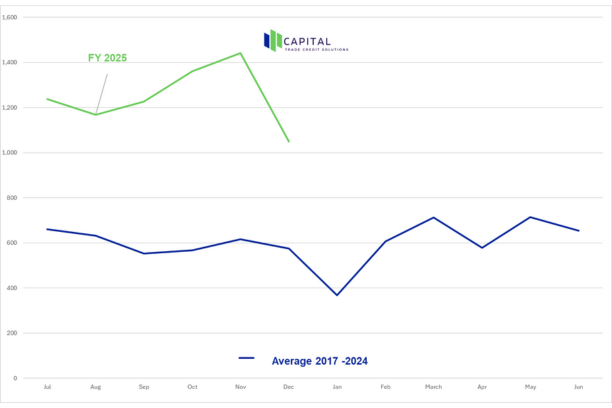

First Time Administrations April 2025

In April FY25, 1,225 businesses entered external administration for the first time—more than double the five-year average of 578.3 and well above April FY24’s 606. While this marks a modest decline from March’s 1,447 insolvencies, the numbers remain alarmingly elevated. Many had hoped March would represent a peak, but April’s figures suggest that financial stress is still widespread and […]

Two Key Moments for Capital Trade Credit Solutions This Week: Real Stories of Growth and Support

Trade Credit Insurance isn’t always the best topic to bring up at a dinner party if you want to be remembered as interesting company. However, it’s genuinely satisfying to see it work in practice and do what we say it will do when we talk to businesses who are thinking about getting it. This past […]

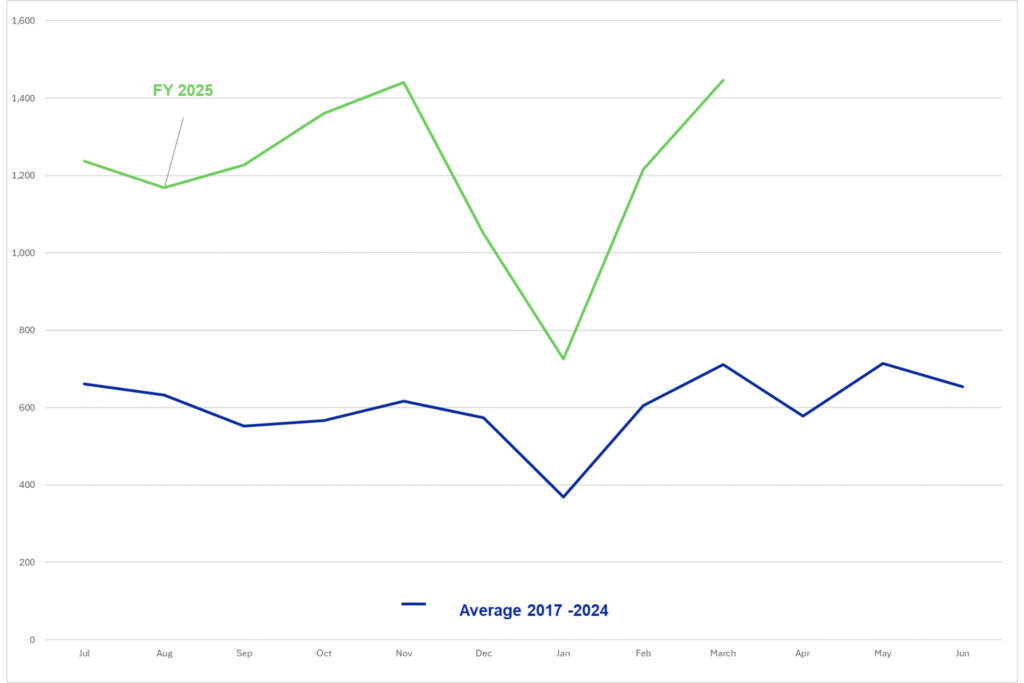

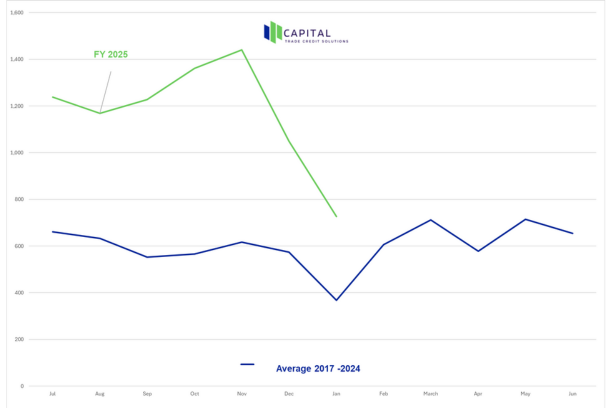

First Time Administrations March 2025

March FY25 saw a continued surge in insolvencies, with 1,447 businesses entering administration for the first time. This number is twice the average of 712.17 recorded over the past five financial years, reflecting the ongoing economic pressures on businesses. The jump from February’s 1,216 insolvencies highlights the persistent instability and unpredictability in the current […]

Why Credit Insurance Can Help You Make More Money, Not Just Protect Your Business

When most businesses first consider credit insurance, they usually think of it as a way to protect themselves from the risk of bad debts. It’s often the first thing that comes to mind when they hear about it, and that’s how most people are introduced to this type of insurance. But what many business owners […]

First Time Administrations February 2025

In February FY25, the anticipated spike in insolvencies materialized, with 1,216 businesses entering administration for the first time. This figure is double the average of 606 since 2017, highlighting the ongoing economic challenges faced by businesses. The significant increase from January’s 726 insolvencies underscores the volatility and uncertainty in the current economic climate. Despite […]

When is the best time to buy credit insurance? – Almost certainly now.

Many businesses are feeling a cash flow crunch at the moment, leading them to reconsider discretionary expenses like credit insurance. As business owners we get that. Recently I had a business owner decline a very competitively priced policy (and it was the only one I could get from the market) due to cashflow problems they […]

First Time Administrations January 2025

In January FY25, the trend of increasing insolvencies continued its seasonal downward trend, with a marked decrease to 726 businesses entering administration for the first time. This aligns with expectations, as January typically sees a decrease before a likely spike in February. The current numbers are still higher than the average of 368.33 over […]

First Time Administrations December 2024

In December FY25, the trend of increasing insolvencies shows a slight reprieve, with 1,050 businesses entering administration for the first time. This follows a similar downward trend seen in previous years, where November figures typically decrease in December (e.g. 2024 saw a drop from 891 in November to 795 in December, and 2023 saw […]